Check CIBIL Score

Check CIBIL Score

What is Credit Score?

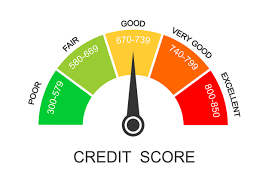

A credit score is a 3-digit numeric summary of your credit history that represents your past credit behavior and how well you have managed your credit products, like personal loans, credit cards, home loans, business loans, auto loans, overdrafts, credit lines, etc. Credit score, which is also commonly referred to as CIBIL score is primarily a measure of your ability to borrow from banks and NBFCs and financial institutions. CIBIL score is calculated and generated based on the consumer's credit information provided by the lenders to credit bureaus on a monthly basis.

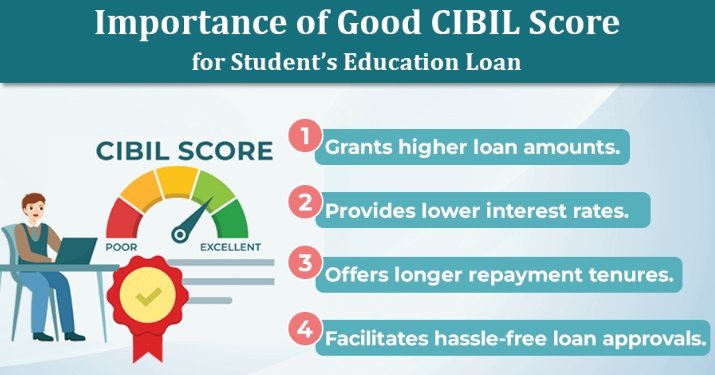

Simply put, your credit score shows lenders whether you are a reliable borrower with minimum risk or a risky one, as well as the likelihood of you repaying a new loan in time. When you apply for any type of loan or a credit card, the lender requests a credit report check from the credit bureau to know your repayment capability and creditworthiness.

CIBIL score ranges from 300-900 in which the higher your credit score, the more likely lenders are to approve you for new credit. Usually, a credit score of 760 and above is considered a standard benchmark and preferred by lenders for loan or credit card approval. For a few banks/NBFCs, even a credit score of 700+ is also considered for credit card approvals.